Navigating the Storm: North Carolina’s Battle with Inflation

Balancing Immediate Relief and Long-Term Economic Stability

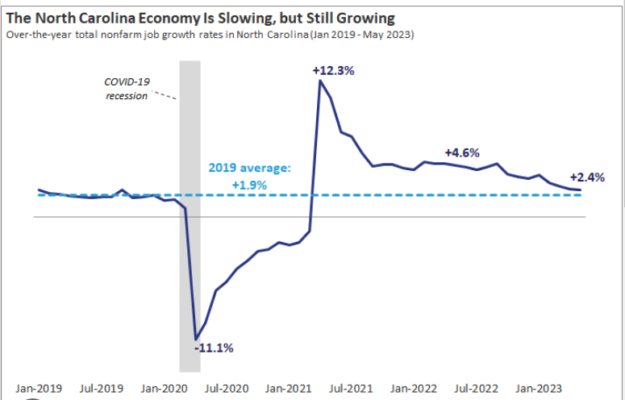

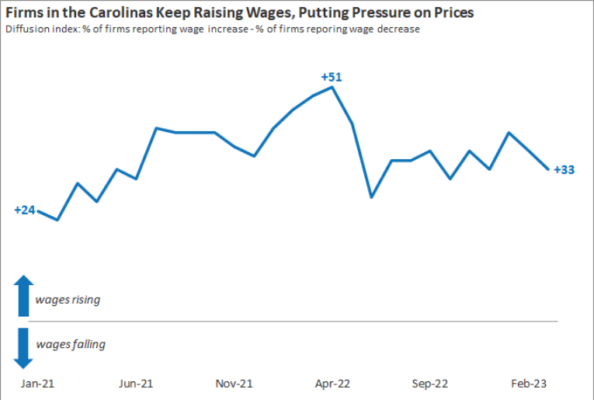

Inflation has surged across the United States, and North Carolina finds itself at the forefront of this economic storm. The state, like many others, grapples with the highest inflation rates since the early 1980s, posing significant challenges to its residents, particularly those already vulnerable. While the inflationary pressure is felt statewide, certain regions, such as the Triangle area, face intensified economic strains due to higher costs of living. As essential expenses like food, gas, and housing continue to skyrocket, the need for immediate relief measures becomes paramount.

Since July 2021, inflation in the Southeast, including North Carolina, has risen by a staggering 9.4%. This surge is predominantly fueled by soaring food and gas prices, with gasoline alone witnessing a daunting 44.3% increase over the period. The repercussions are tangible, with residents experiencing a substantial dent in their purchasing power. In areas like Chapel Hill-Durham, where gas prices have surged by approximately 80 cents compared to 2021, the strain on household budgets is palpable.

However, the burden of inflation is not borne equally. Lower-income households, already stretched thin, face disproportionate impacts as they allocate a larger share of their income to essential expenses like food and gas. Gerald Cohen, chief economist at the Kenan Institute of Private Enterprise, underscores this disparity, particularly in regions with higher costs of living like the Triangle area. Here, economic inequality exacerbates the challenges faced by vulnerable communities, amplifying the urgency for targeted relief measures.

The inflationary trend extends its reach into the housing market, where rent prices continue to climb unabated. With approximately half of North Carolina’s renters already spending more than 30% of their income on housing, the situation is dire. For individuals like Keenan Schlecht, whose monthly rent surged by 64% over four years, the prospect of affordable housing becomes increasingly elusive, further straining their financial stability.

In response to these challenges, both federal and local initiatives have been mobilized to provide relief and chart a path toward long-term economic stability. The Inflation Reduction Act of 2022 introduces a slew of social and monetary policy actions aimed at combatting high inflation. Measures such as tax credits for renewable energy investments signal a commitment to sustainable solutions, albeit with a recognition that their impact may take time to materialize fully.

On a local level, North Carolina’s counties are rolling out targeted programs to alleviate the burden on residents most affected by inflation. Orange County’s Housing Choice Voucher Program, Emergency Housing Assistance fund, and Low Income Energy Assistance Program exemplify efforts to provide immediate relief for housing, utilities, and heating expenses. Moreover, initiatives to bolster small businesses and create stable, well-paying jobs signal a multi-pronged approach to address the root causes of inflationary pressure.

As North Carolina navigates these turbulent times, the imperative lies in striking a delicate balance between providing immediate relief for those in need and implementing sustainable, long-term economic strategies. While targeted programs offer a lifeline for vulnerable communities grappling with the immediate impacts of inflation, a concerted effort toward structural reforms and investment in renewable energy sources holds the promise of mitigating inflationary pressures over the long haul.

Read More News:

- Honoring Hanna Gillion: A Pioneer in Women’s Sports at the University of Alabama

- Small Plane Crash on Interstate 75 Claims Two Lives in Florida

In conclusion, North Carolina’s battle with inflation underscores the need for proactive measures to safeguard the well-being of its residents and foster economic resilience. By prioritizing both short-term relief efforts and forward-thinking policies, the state can weather the storm of inflation while laying the groundwork for a more equitable and sustainable future.