Unprecedented Resilience: US Job Market Surges in January Defying Economic Expectations

Robust Gains, Wage Hikes, and a Steady Unemployment Rate Paint a Positive Economic Picture

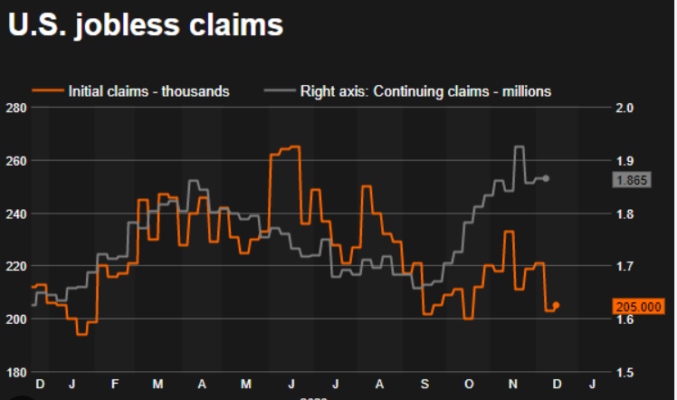

In an unexpected twist, the United States job market has once again defied economic forecasts, showcasing unparalleled resilience in January. The latest report from the Labor Department reveals the addition of 353,000 jobs, coupled with a significant surge in average hourly pay. Remarkably, the unemployment rate remained steady at 3.7%, confounding expectations of a slowdown prompted by rising interest rates since 2022. This report not only surprises economists but also paints a positive and robust picture of the US economy.

The January job report has left economists surprised, extending a streak of positive job gains that has persisted despite predictions of an economic slowdown. The addition of 353,000 jobs surpasses expectations, indicating a buoyant job market. Neil Birrell from Premier Miton Investors notes, “These numbers show the US economy to be strong and will sway anyone thinking a March rate cut was on the way to look further out. Any thoughts of recession are off the mark as well for now.”

Economic Stability Amidst Rising Interest Rates

Analysts are quick to point out that the unexpected strength in the job market makes an early rate cut less likely. The Federal Reserve’s decision to raise interest rates since 2022 aimed to cool economic activity and mitigate inflationary pressures. While inflation has moderated from the peaks of 2022, standing at 3.4% in December, the resilience in household spending has created a positive feedback loop. Robust job market conditions continue to support consumer spending, contributing to the overall economic stability.

Jerome Powell, the head of the US central bank, recently expressed cautious optimism about the trajectory of inflation and the broader economic landscape. Powell stated that officials are optimistic about inflation continuing to decline without triggering a severe downturn. However, he emphasized the need for “greater confidence” before considering a reduction in borrowing costs. Powell’s remarks underline the central bank’s prudent approach to interest rates and its commitment to ensuring a secure economic outlook.

Contrary to expectations of a rate reduction in March by some investors, Powell indicated that such a move was unlikely. The central bank’s measured stance reflects a desire for a more assured economic environment before contemplating adjustments to interest rates.

The January job gains were not limited to a specific sector, showcasing a diversified and resilient labor market. Contributions from health care, retail, and business and professional services played pivotal roles in propelling employment growth. This sectoral diversity highlights the adaptability of the US job market, with various industries contributing to the overall economic momentum.

Evaluating Economic Confidence

The unexpected strength in the January job market injects a sense of confidence into the economic landscape. Despite concerns about rising interest rates and potential economic headwinds, the data suggests that the US economy remains robust and adaptable. The intricate interplay between employment, inflation, and consumer spending will continue to shape economic policies and market expectations in the coming months.

The January job report serves as a testament to the unprecedented resilience of the US job market. The surprising surge in employment, coupled with wage hikes and a steady unemployment rate, paints a positive economic picture. This resilience challenges notions of an imminent economic slowdown and showcases the adaptability of the US economy in the face of changing conditions.

Read More:

- Navigating the Future: PGA Tour’s Strategic Alliances and Ongoing Saudi PIF Negotiations

- Culinary Creativity Unleashed: The Gastronomic Trio of Polite Society, The Bellwether, and Sub Division Sandwich Co. in St. Louis

As the United States navigates evolving economic dynamics, the January job report stands as a beacon of economic strength. The careful and measured approach of the Federal Reserve, led by Jerome Powell, reflects a commitment to sustaining economic stability. The coming months will undoubtedly witness continued scrutiny of economic indicators, with the job market playing a pivotal role in shaping the trajectory of the US economy.