A Game-Changing Online Tool Simplifies Tax Filing Process for Eligible Taxpayers

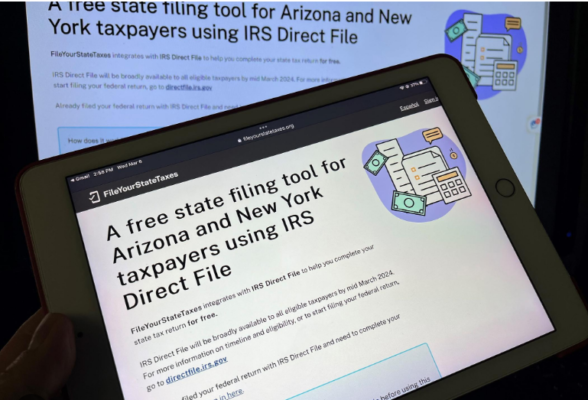

In a landmark development for tax filers across the United States, the Internal Revenue Service (IRS) has unveiled Direct File, a revolutionary electronic system designed to streamline the process of filing federal income taxes. The Direct File system represents a significant step forward in tax administration, offering eligible taxpayers from 12 selected states a free and user-friendly online tool to submit their returns directly to the IRS. This innovative initiative promises to enhance efficiency, accessibility, and convenience for millions of Americans navigating the complexities of tax season.

After undergoing rigorous testing and development, Direct File is now available to taxpayers residing in Massachusetts and 11 other states. This eagerly awaited launch marks a major milestone in the IRS’s ongoing efforts to modernize tax filing procedures and empower taxpayers with greater control over their financial obligations. With Direct File, eligible individuals with straightforward tax situations—characterized by simple W-2 forms and standard deductions—can take advantage of a seamless online platform to file their federal income taxes with ease and accuracy.

Direct File offers a host of compelling features tailored to meet the needs of today’s taxpayers. The user-friendly interface simplifies the tax filing process, guiding users through each step with clear instructions and intuitive navigation. Taxpayers can securely submit their returns directly to the IRS, eliminating the need for cumbersome paperwork and reducing the risk of errors or delays associated with traditional filing methods. Moreover, Direct File prioritizes accessibility by offering a Spanish version of the platform, ensuring that non-English speakers can benefit from its services.

The introduction of Direct File represents a paradigm shift in tax administration, heralding a new era of efficiency and convenience for taxpayers nationwide. By leveraging cutting-edge technology and user-centric design principles, the IRS aims to streamline the tax filing process and enhance the overall taxpayer experience. With Direct File, individuals can file their federal income taxes from the comfort of their homes or offices, eliminating the need for costly professional assistance or time-consuming visits to tax preparation centers.

The availability of Direct File underscores the IRS’s commitment to promoting financial literacy and empowering taxpayers with the tools they need to navigate the complexities of the tax system. By offering a free and accessible online filing solution, the IRS seeks to level the playing field for individuals from diverse socioeconomic backgrounds, ensuring that all taxpayers have equal access to essential tax services. Whether filing independently or with the assistance of a tax professional, eligible individuals can leverage Direct File to fulfill their tax obligations efficiently and accurately.

As tax season unfolds, eligible taxpayers in the 12 selected states are encouraged to explore the benefits of Direct File and take advantage of this groundbreaking online tool. By embracing innovation and embracing digital solutions, taxpayers can simplify their tax filing process and maximize their refunds in a timely manner. With Direct File, the IRS aims to foster greater transparency, accountability, and compliance within the tax system, paving the way for a more equitable and efficient tax administration framework.

Read More News:

- Tackling the Surge: A Holistic Approach to Curb Gang Violence in Brooklyn

- Alarming Airstrike Claims Lives of Al-Jazeera Journalists in Gaza

Looking ahead, the IRS remains committed to expanding the reach of Direct File and enhancing its functionality to better serve the needs of taxpayers across the country. By soliciting feedback from users and stakeholders, the IRS will continue to refine and improve the Direct File platform, ensuring that it remains a trusted and indispensable resource for tax filers of all backgrounds. With Direct File, the IRS is revolutionizing tax filing for the digital age, ushering in a new era of convenience, accessibility, and efficiency for millions of Americans.